As a business owner, I know the importance of following U.S. laws and regulations. This keeps my business safe and successful. Small business owners must think about many legal things, such as which legal structure to use. This also includes keeping their ideas and customer information safe. I’ll give you nine legal tips to help build a strong legal base for your business.

Choosing the right legal structure is a key first step. This choice affects how you pay taxes, your personal risks, and how you can grow. Entities like corporations, LLCs, or partnerships can help protect your personal things. It also makes sure you follow the tax laws for businesses. Getting advice from a business lawyer is smart to pick the best one for your business.

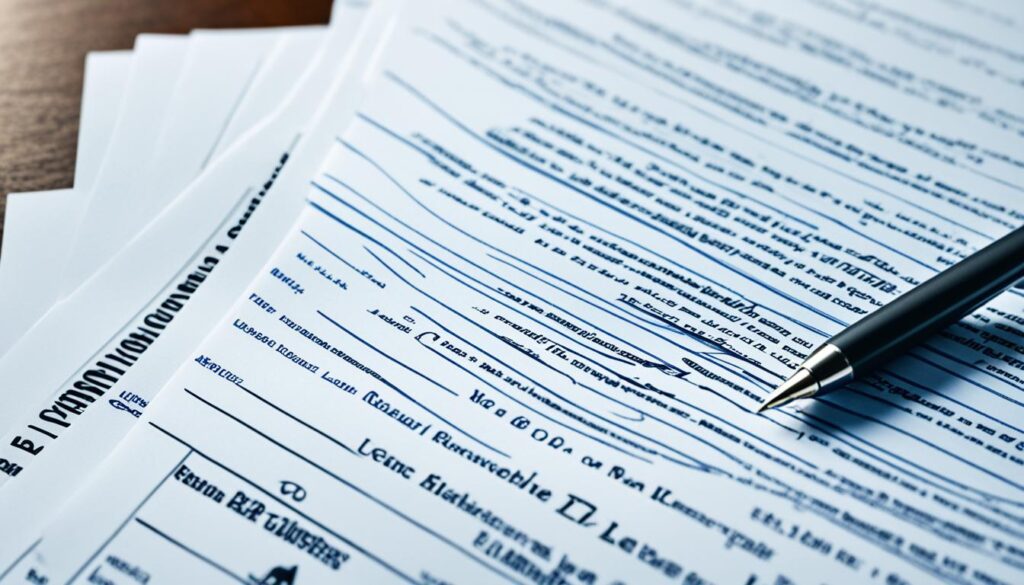

Filling out the right legal paperwork is very important for small businesses. Different legal structures need different documents, like articles of incorporation or organization. These documents are needed for how you run the business, make decisions, and follow laws. Having these documents ready can prevent legal troubles and keep your business running smoothly.

Today, protecting your ideas and privacy is more crucial than ever. Registering patents, trademarks, and copyrights can keep your brand safe. A strong privacy policy is essential to protect both customer and worker information. Using cybersecurity stops hackers from getting into your systems. Following the rules for ads and marketing avoids trouble for false advertising. It’s a good idea to get legal advice to make sure your business is fully protected.

Key Takeaways:

- Choosing the right legal structure is crucial for business owners to protect personal assets and ensure compliance with tax laws.

- Completing necessary legal documents helps establish clarity and compliance in business operations.

- Protecting intellectual property and privacy safeguards business assets and customer data.

- Implementing cybersecurity measures is essential to prevent unauthorized access to sensitive information.

- Complying with advertising and marketing regulations helps avoid legal consequences for deceptive practices.

Choosing the Proper Legal Entity Structure

For a small business owner, picking the right legal structure is critical. It affects the business’s tax situation, borrowing options, and future sale strategy. Setting up as a separate legal entity helps protect personal assets and prevents being personally responsible for business debts. You can pick from a corporation, an LLC, or a partnership. Talking to a business attorney can guide you to the best choice for your business.

| Legal Entity Structure | Business Taxes | Personal Liability |

|---|---|---|

| Corporation | Subject to corporate taxes | Limited personal liability |

| LLC (Limited Liability Company) | Can choose to be taxed as a partnership or a corporation | Limited personal liability |

| Partnership | Pass-through taxation | Unlimited personal liability |

Completing Necessary Legal Documents

Running a small business means being on top of the law. You must complete and file the right legal documents with your state. What you need changes based on your business’s legal structure.

If your business is a corporation, file articles of incorporation. For a limited liability company (LLC), file articles of organization. These documents show your business is official and outlines its purpose.

Other key legal documents are needed too. You might need resolutions for important choices, good bookkeeping, to follow labor laws, get licenses, and outline stockholder rules.

These documents create clear rules for how your business works. They help you follow laws and make sure your business runs smoothly.

Common Legal Documents for Small Businesses

| Legal Entity Structure | Required Legal Documents |

|---|---|

| Corporation | Articles of Incorporation, Resolutions, Stockholder Agreements |

| LLC (Limited Liability Company) | Articles of Organization, Operating Agreement |

| Partnership | Partnership Agreement, Contribution Agreement |

Getting advice from a business attorney is key. They will help make sure you file all the right legal documents. This is important for your business’s strong legal start.

Protecting Intellectual Property and Privacy

As a small business owner, my intellectual property is crucial. This includes patents and copyrights, which safeguard our logos and business names from misuse.

It’s also vital to keep customer and employee information private. We do this through a detailed privacy policy. This policy helps build trust with those who use our services. It ensures their info is handled with care and follows all rules.

In the digital world, keeping cyber information safe is a big challenge. We use strong security and teach our team about cyber threats. Protecting digital info is key to keeping our business and those we serve secure.

Staying honest and transparent in our marketing is essential. We follow advertising rules to avoid trouble and act ethically. This includes not tricking customers and respecting their rights.

FAQ

What are some legal tips for business owners?

For business owners, legal tips are key. First, pick the right legal structure. Then, finish any paperwork you need. Make sure to always use contracts.

Next, follow all work laws. Protect your brand and ideas. Keep both customer and worker info safe. Cybersecurity is crucial.

Also, stick to the rules on how you advertise. This keeps you away from legal trouble.

Why is choosing the proper legal entity structure important?

Picking the right structure affects many things. It decides your taxes and borrowing freedom. It also shapes what you can do with the business later.

This choice means your business stands on its own. This shields your personal stuff from getting tied to business debts.

What legal documents do small business owners need to complete?

Small business owners have paperwork to deal with based on their setup. Corporations file articles of incorporation. LLCs file articles of organization.

They must also create resolutions. These are for running the business, keeping records, and following work laws. They also need licenses and stockholder rules.

Why is protecting intellectual property and privacy important?

It’s crucial for small businesses to protect their ideas and data. Patents and trademarks protect your brand. A privacy policy shields personal info.

With cyber threats rising, securing digital data is a must. Watch your ads and marketing too. Following the rules keeps you out of legal hot water.

Source Links

- https://aofund.org/resource/small-business-legal-advice-10-basics-business-owners/

- https://aselfguru.com/legal-tips-for-small-business-owners/

- https://thedoylelawoffices.com/blog/legal-tips-for-small-businesses/